July 31, 2020 - To build an understanding of current labor market trends and conditions that are impacting the Memphis Metro area, the Chamber will release an update to our economic recovery in two-week intervals. With the release of the June 2020 unemployment numbers on July 29, these updates will provide a key snapshot of where the Memphis market sits as it relates to a recovery in the local economy.

The Greater Memphis Chamber develops insights that help stakeholders ask the right questions to issues impacting our region’s economic competitiveness. To understand the impact of COVID in the current economic environment, the team analyzes data using a combination of sources such as the Bureau of Labor and Statistics as well as cutting-edge tools such as Burning Glass Labor Insights and EMSI, the Chamber aims to provide stakeholders with information that can help drive prosperity for all in the region.

This week’s update includes:

- The National Bureau of Economic Research officially declared the US economy in a recession on Monday, June 8. Starting in February, this recession ends a decade long period of economic expansion and the longest in recorded US history.

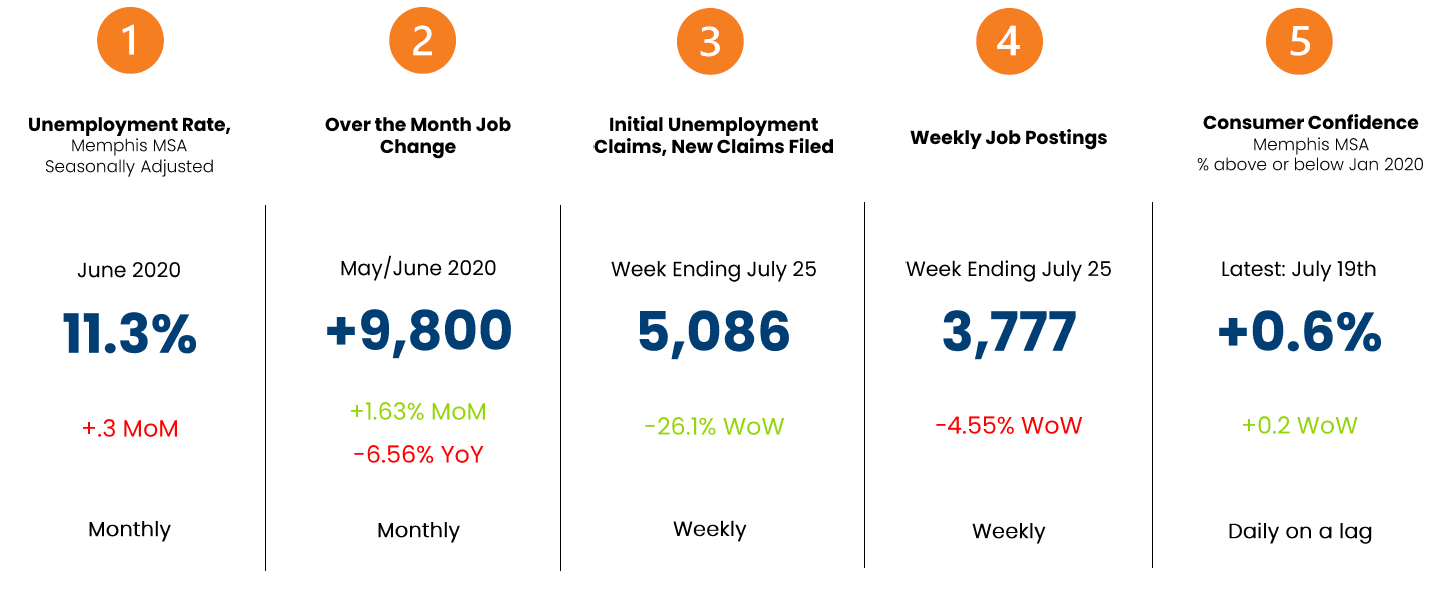

- This edition of the Greater Memphis MSA Market Overview highlights select labor market indicators that are published on a monthly and a weekly schedule.

- The higher frequency weekly indicators, noted within the report, serve as leading indicators and could signal worsening or better employment outcomes for the region against the monthly reports.

Indicators to Watch

Key insights from this report:

- Monthly Indicators, [lower frequency]

- June 2020, the unemployment rate in the Greater Memphis MSA rose 0.3 seasonally adjusted points to 11.3%. This increase places the market higher than both the State of Tennessee and the Nation at 9.7% and 11.1%, respectively. Shelby County holds the highest unemployment rate in the State, with a June 2020 rate of 13.2%. The next release for (July 2020) metropolitan employment estimates will be September 2, 2020.

- With over 70,000 individuals unemployed in the metro area (June 2020), displaced workforce should leverage transferable skills, discoverable through the SkillsMatch and the Resume Optimizer applications. Leveraging transferable skills will allow for the development of competitive language and positioning in a sector that is currently hiring.

- Non-farm payrolls (jobs) in the Memphis metropolitan area increased by nearly 10,000 in June 2020, a month-over-month increase of approximately 1.6%.

- The net increase in month-over-month jobs was primarily realized through Leisure and Hospitality industries which added 12,500 jobs in June. This sector has regained nearly 75% of jobs lost in April. However, recovery looks different for every industry, with many only regaining a fraction of jobs lost.

- Weekly Indicators, [higher frequency]

-

- Initial and continued unemployment insurance claims continue to remain at relatively high levels. The levels displayed through the month of July could reflect headwinds realized in tandem with the continued increases in COVID-19 cases.

- Online job postings, a proxy for employer demand, decelerated in the first half of July. While online job postings remain above the May 2 trough, there has been a 21.2% drop over the weeks ending June 27 to July 25, 2020. While indicative of demand, opportunities to shift labor market displacement exists - leveraging skills of displaced workers for in-demand occupations within new industries.

- While the Greater Memphis market has seen a rise in June 2020 unemployment rate, many employers have ramped up in hiring. This ramp-up suggests that a shift in workforce requirements is being realized and will remain as industries stabilize in the near-term.

Questions? We would love to hear from you! Click here to send a question or request media access.